The business cycle represents the fluctuations in economic activity that an economy experiences over time. It consists of periods of expansion and contraction.

Understanding the business cycle is crucial for businesses and investors as it affects decisions related to investment, employment, and pricing. It’s a fundamental concept in economics that helps policymakers, and individuals anticipate changes in the economic environment. The cycle typically includes four stages: expansion, peak, contraction, and trough.

During expansion, the economy grows as consumers spend more and businesses invest, leading to higher employment rates. At the peak, the economy hits its highest point before slowing down. Contraction, or recession, follows, with reduced spending and investment, leading to job losses. Finally, the trough is the lowest point, after which the cycle starts anew with recovery and expansion. Identifying where an economy is within the business cycle can inform strategic planning and financial forecasting.

Unveiling The Business Cycle

The business cycle shows how economies grow and shrink over time. It’s like a heartbeat for money and jobs.

The Heartbeat Of The Economy

Think of the business cycle as the economy’s heartbeat. Just like your heart beats faster when you run and slows down when you rest, the economy grows and contracts in similar patterns.

- Expansion: This is when the economy grows. Jobs are plentiful, and businesses expand.

- Peak: The highest point of growth. It doesn’t last forever.

- Recession: A period when the economy slows down. Jobs might be harder to find.

- Trough: The lowest point, similar to taking a rest.

- Recovery: After resting, the economy starts to grow again.

Cyclical Nature Of Growth And Recession

The business cycle is predictable yet surprising. We know these stages will occur, but we can’t always tell when or how long they will last.

| Stage | What Happens |

|---|---|

| Expansion | Businesses grow, more jobs. |

| Peak | Growth at its highest. |

| Recession | Slowdown in the economy. |

| Trough | Lowest economic activity. |

| Recovery | Economy improves again. |

Understanding these cycles helps businesses and governments make better decisions. It helps them prepare for tough times and take advantage of good times.

Phases Of The Business Cycle

Understanding the Phases of the Business Cycle is like following the journey of an economy. It’s a path of growth, peak, decline, and recovery. Each phase plays a crucial role. Experts analyze these to predict future performance. Let’s explore these phases one by one.

Expansion: The Upward Trajectory

The expansion phase signifies growth. During this phase, businesses thrive, jobs are plentiful, and the economy blooms. Key indicators of this phase include:

- Rising employment rates

- Increased consumer spending

- Heightened industrial production

Economies aim to maintain this upward trajectory for as long as possible.

Peak: The Pinnacle Of Economic Activity

The peak is the summit of economic growth. It’s where expansion maxes out. Signs of a peak include:

| Indicator | Characteristic |

|---|---|

| Business Profits | At their highest |

| Unemployment | At its lowest |

| Inflation | May start to rise |

This is the stage just before the economy starts to cool down.

Recession: The Inevitable Downturn

A recession marks a decline. It’s when the economy starts to shrink. Here’s what happens:

- Companies cut costs, often through layoffs

- Consumer spending drops

- Investment falls

Recessions can be short-lived or drag on, deeply affecting the economy.

Trough: The Economy’s Lowest Point

The trough is the bottom of the cycle. It’s when the economy hits rock bottom. Key features include:

- High unemployment rates

- Low consumer confidence

- Decreased business activity

After the trough, the cycle resets as the economy begins to recover.

Indicators Of Economic Health

Understanding the health of an economy is crucial. Businesses, investors, and policymakers track several vital signs. These signs show how an economy is doing. They can predict future growth or decline. Let’s look closely at these indicators.

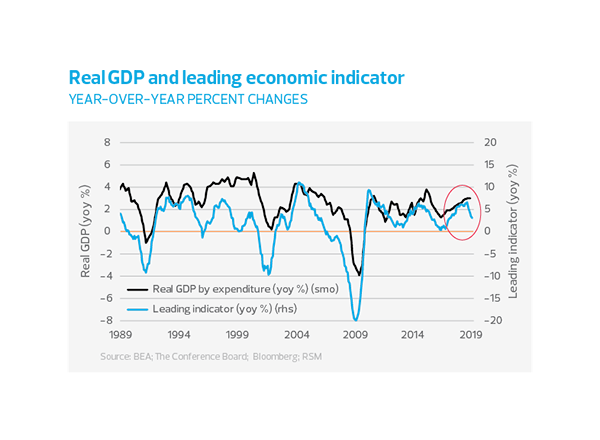

Gdp: The Broad Measure

Gross Domestic Product (GDP) is a key indicator. It measures a country’s economic output. A rising GDP suggests a healthy economy. A falling GDP points to trouble. Economists look at GDP growth rates for trends.

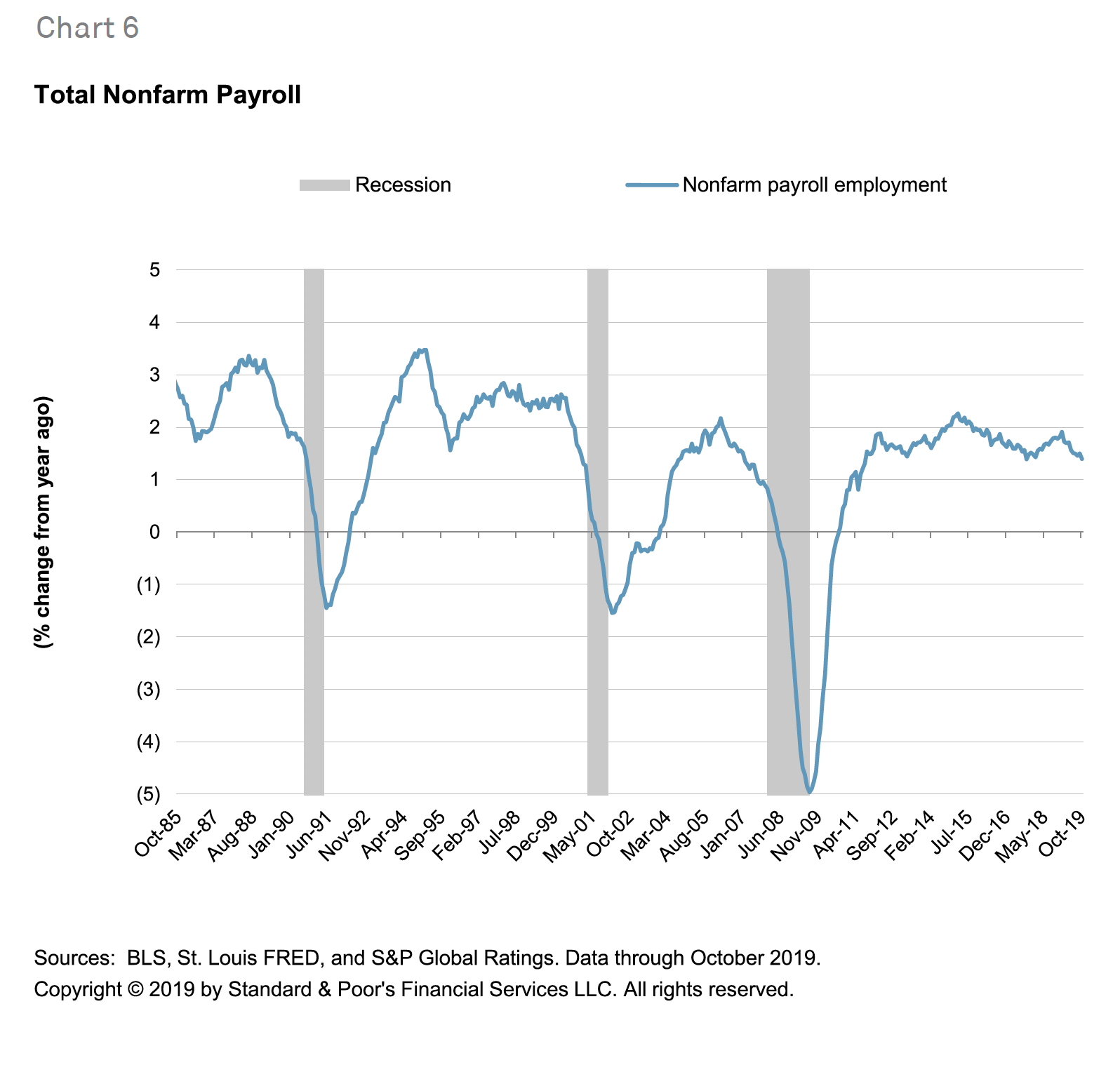

Employment Rates: A Reflection Of Prosperity

Employment rates tell us about job health. More people working means more prosperity. High employment rates boost economic growth. They signal strength. Low rates can mean economic stress.

- High employment: People have jobs and can spend money.

- Low employment: People struggle, spending less.

Inflation: The Silent Indicator

Inflation affects the economy’s balance. It’s the rate at which prices for goods and services rise. Low, stable inflation is good. It means the economy is stable. High inflation can reduce buying power. This can slow economic growth.

| Level of Inflation | What it Indicates |

|---|---|

| Low | Stable prices, good for growth |

| High | Prices rise, buying power drops |

Credit: rsmus.com

Forces Driving The Cycles

Understanding the business cycle is key to grasping how economies expand and contract over time. These fluctuations result from various forces that drive economic activity. Exploring these forces reveals the underlying causes of economic growth and downturns.

Consumer Confidence And Spending

Consumer behavior is a powerful force in the business cycle. Consumer confidence reflects the overall sentiment that households have about the economic climate. When confidence is high, spending increases, leading to more production and employment. Conversely, low confidence can cause spending to decline, which may trigger a slowdown. Key factors influencing consumer confidence include:

- Job security

- Income growth

- Debt levels

- Interest rates

Government Policies And Their Impact

Government policies play a crucial role in shaping the business cycle. Fiscal policies, including taxation and government spending, directly affect economic activity. Monetary policy, managed by central banks, controls money supply and interest rates. These policies aim to stabilize or stimulate the economy. Significant policy tools include:

| Policy Type | Tools | Impact |

|---|---|---|

| Fiscal | Tax cuts, public spending | Adjust aggregate demand |

| Monetary | Interest rates, reserve requirements | Influence inflation and growth |

Global Influences And Market Dynamics

The global economy also affects national business cycles. International trade, foreign investment, and economic policies of other countries can have a significant impact. Market dynamics, including supply and demand, commodity prices, and exchange rates, are all influenced by global trends. Key global factors include:

- Trade agreements and tariffs

- Foreign investment flows

- Currency fluctuations

- Global economic indicators

Historical Perspectives On Business Cycles

Business cycles track the rise and fall of economic growth over time. They show how economies expand and contract. History offers rich insights into these patterns. Let’s dive into some pivotal moments that shaped our understanding of business cycles.

The Great Depression: A Cycle Of Despair

The Great Depression remains a dark period in economic history. It began in 1929 and lasted for a decade. The stock market crashed. Millions lost jobs. This period stands as a classic example of a business cycle downturn.

- Unemployment soared to 25%

- Global trade fell by 65%

- It led to major reforms in economic policies

Post-war Booms: Cycles Of Rebirth

After World War II, economies saw rapid growth. This era is known for its rebirth of industry and innovation. The post-war boom showed how economies can rebound and grow after a downturn.

- Many countries saw record-high growth rates

- The creation of new technologies and industries emerged

- Consumer demand skyrocketed

Dot-com Bubble: A Modern Cycle Case Study

In the late 1990s, the dot-com bubble was a modern example of a business cycle. It was a time of high investment in internet-based companies. Eventually, it burst, leading to a market crash in the early 2000s.

| Year | Event |

|---|---|

| 1995-2000 | Internet stocks soared |

| 2000 | Market peaked and crashed |

| 2001 | Economy entered recession |

Each of these historical moments teaches us about the nature of economic fluctuations. They help us prepare for future cycles in the business world.

:max_bytes(150000):strip_icc()/Investopedia-terms-business-cycle-eb0d2a616c914caf87c35491ed78ae2e.jpg)

Credit: www.investopedia.com

Predicting Economic Fluctuations

Understanding the ups and downs of the economy can be like reading a road map with no signs. Predicting Economic Fluctuations is a crucial part of planning for businesses and governments alike. Let’s dive into how experts forecast these changes.

The Role Of Economic Forecasts

Economic forecasts play a vital role in anticipating market trends. They use data and trends to make educated guesses about the future. Here are key points:

- Forecasts guide policy decisions and business strategies.

- They rely on historical data and current economic indicators.

- Economists use models to predict growth, inflation, and employment rates.

Business leaders and policymakers depend on these predictions to make informed decisions.

Limitations Of Prediction Models

While forecasts are helpful, they are not always right. Prediction models have limits. Here’s why:

- Unexpected events can disrupt even the best models.

- Models rely on assumptions that may not hold true.

- Accuracy diminishes the further out the forecast goes.

Being aware of these limitations helps us use forecasts more wisely.

Mitigating The Adverse Effects

The business cycle reflects the rise and fall of economic activity over time. Mitigating the adverse effects of these fluctuations is key to maintaining stability. Understanding how to smooth these cycles and bolster resilience is essential for policymakers and businesses alike.

Policy Tools For Smoothing Cycles

Policy tools are like levers that governments can pull to keep the economy steady. These tools aim to level out the bumps in the road that businesses and consumers experience during different phases of the business cycle.

- Fiscal Policy: Governments adjust spending and taxes to influence economic conditions.

- Monetary Policy: Central banks alter money supply and interest rates to regulate economic growth.

- Regulatory Measures: These include policies to ensure fair competition and to prevent market failures.

Business Strategies For Cycle Resilience

Businesses can adopt strategies to weather economic storms. By planning ahead and being flexible, they can navigate through tough times.

- Diversification: Spreading investments can reduce risk.

- Cash Flow Management: Keeping a close eye on cash flow helps in making informed decisions.

- Adaptive Operations: Being able to adjust operations quickly can safeguard against sudden changes in the market.

Credit: www.spglobal.com

The Future Of Business Cycles

The Future of Business Cycles remains an intriguing subject for economists and business leaders alike. With rapid changes in technology and global interconnectivity, predicting the ebb and flow of economic prosperity and downturns becomes more complex. Understanding the potential shifts and preparing for the future is key to navigating the business landscape.

Technological Advancements And Their Influence

Technological progress reshapes business cycles in profound ways. Innovations lead to increased productivity, new industries, and job creation. Yet, they can also disrupt existing markets and contribute to economic shifts. The digital revolution, artificial intelligence, and automation stand out as game-changers.

- Automation reduces costs but can displace jobs.

- Artificial Intelligence optimizes operations but prompts new regulatory challenges.

- Digital Platforms connect global markets but can quickly alter competitive landscapes.

Preparing For Uncertainty In A Globalized World

In a world where national economies are tightly linked, a ripple in one market can become a wave in another. Companies must plan for various scenarios and remain agile. Diversification, risk management, and adaptability are critical components of a robust strategy.

- Diversification: Spread investments to mitigate risk.

- Risk Management: Identify potential threats and develop contingency plans.

- Adaptability: Stay open to change and ready to pivot when necessary.

Frequently Asked Questions

What Is Business Cycle In Simple Words?

A business cycle is the natural fluctuation of economic activity over time, encompassing periods of expansion and contraction.

What Are The 4 Phases Of The Business Cycle?

The four phases of the business cycle are expansion, peak, contraction, and trough. Each phase marks a distinct stage in economic activity, from growth to decline and eventual recovery. Understanding these phases helps businesses and investors make informed decisions.

What Is The 5 Step Business Cycle?

The 5-step business cycle includes expansion, peak, contraction, trough, and recovery. During expansion, the economy grows. At the peak, growth reaches its maximum. Contraction sees a decline in growth. The trough is the lowest point. Recovery follows as growth starts to rise again.

What Is The Full Cycle Of A Business?

The full cycle of a business encompasses idea generation, planning, launch, growth, maturity, and potential renewal or decline.

Conclusion

Understanding the business cycle is crucial for strategic planning and economic forecasting. By recognizing the patterns and phases, businesses and investors can make informed decisions. Remember, knowledge of the cycle’s ebb and flow empowers stakeholders to navigate economic shifts with confidence.

Stay prepared, stay informed, and embrace the cycle’s predictability to drive success.

Sotto TV We Publish technology, various types of tips, career tips, banking information, methods of earning online

Sotto TV We Publish technology, various types of tips, career tips, banking information, methods of earning online