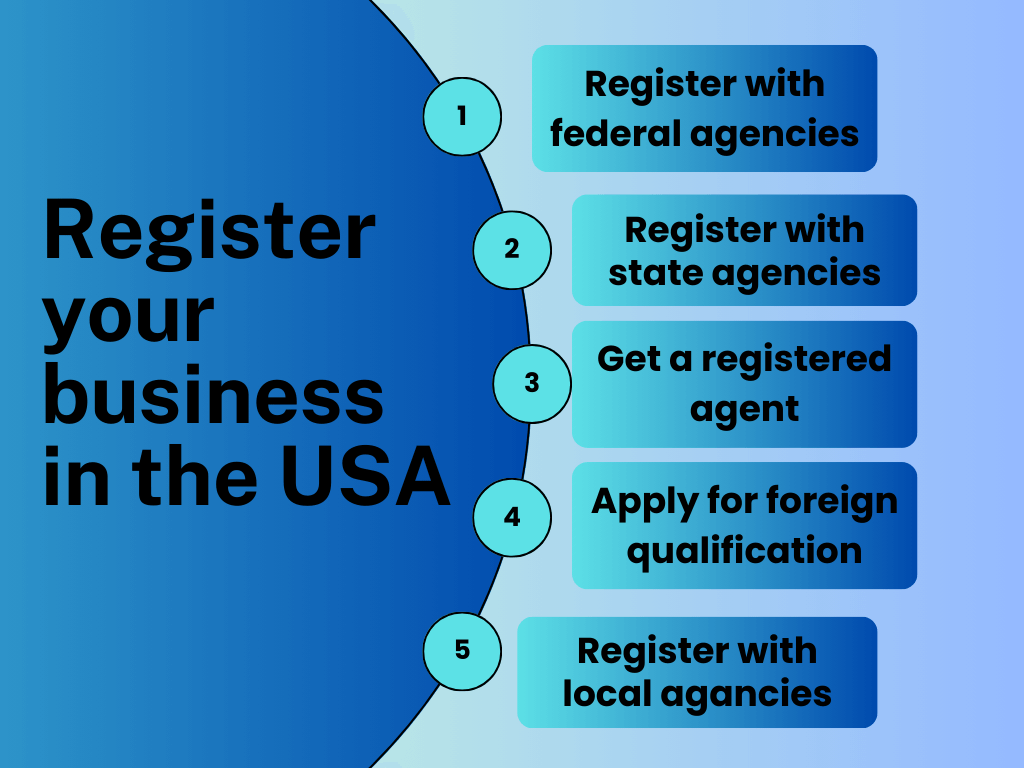

To register a business in the USA, start by choosing a business structure and state of formation. Next, obtain the necessary permits and licenses from local, state, and federal agencies.

Starting a business in the United States involves several critical steps that ensure legal compliance and operational readiness. Entrepreneurs must select an appropriate business entity, such as a sole proprietorship, partnership, limited liability company (LLC), or corporation. This decision impacts tax obligations, personal liability, and business operations.

After deciding on the structure, the next move is to register with the state where the business will operate, which typically requires filing articles of incorporation or organization and paying a fee. A registered agent must also be designated to receive legal documents. Securing an Employer Identification Number (EIN) from the Internal Revenue Service (IRS) is essential for tax purposes. This process lays the foundation for a successful business launch, paving the way for obtaining any industry-specific licenses and opening doors to financing opportunities.

Introduction To Business Registration In The Usa

Starting a business in the USA is an exciting venture. Registration is a key step for any new business. It lays the groundwork for legal operations. It also opens doors to essential benefits that can help the business thrive. This guide will walk you through why business registration is crucial and the benefits it brings to your business.

Why Registering Your Business Is Crucial

Registering your business is more than a formality. It’s a crucial step that protects your brand and solidifies your presence in the marketplace. Without registration, your business lacks legal recognition. This can lead to significant risks and limitations. Let’s explore the core reasons why registering your business sets you up for success.

- Provides legal protection for your brand and name

- Enables you to hire employees legally

- Facilitates the opening of business bank accounts

- Helps in obtaining business loans and lines of credit

Benefits Of Official Business Recognition

Once your business is registered, you unlock a suite of benefits. These benefits can propel your business forward. Official recognition from the government provides your business with credibility and trust. Here are the key benefits you’ll enjoy:

- Enhanced credibility with customers and suppliers

- Access to small business grants and tax incentives

- Legal protection of personal assets

- Ability to enter into formal contracts and expand business operations

Choosing Your Business Structure

When starting a business in the USA, selecting the right structure is vital. This choice affects your taxes, paperwork, and personal liability. Let’s explore different business structures and their pros and cons.

Sole Proprietorship

Sole Proprietorship is the simplest form of business. You own the company and make all decisions. Here are its features:

- Easy to form and operate.

- Minimal regulatory burden.

- Owner faces unlimited personal liability.

- Profits are taxed as personal income.

Llc

An LLC (Limited Liability Company) combines the benefits of a corporation and a partnership. Here are the details:

| Feature | Pros | Cons |

|---|---|---|

| Liability | Limited personal liability | More expensive to form than sole proprietorship |

| Taxation | Flexible tax options | Potential for higher fees |

| Regulations | Less strict than corporations | Varies by state |

Corporation: Pros And Cons

A Corporation is more complex but offers significant benefits. It is ideal for larger businesses. Key points include:

- Owners have limited liability for business debts.

- Corporations can raise capital through stock.

- More regulatory paperwork and costs.

- Taxed as a separate entity, which can lead to double taxation.

Understanding State-specific Business Structures

Each state in the USA may have different rules for business structures. For example, some states offer benefits for certain types of businesses. It is important to:

- Research your state’s requirements.

- Consider local tax implications.

- Consult with a local business advisor.

Choosing the right business structure in the USA is crucial for your success. Make sure to consider all options and consult professionals if needed.

Naming Your Business

Choosing a name for your business is like laying the first brick in building your corporate identity. A good name reflects your brand’s personality, sticks in customers’ minds, and can even describe the products or services you offer. Let’s explore the creative and legal steps you need to take to ensure your business name sets you up for success.

Creative And Legal Considerations

Brainstorming a unique and catchy name is your first step. Think about what makes your business special. Use words that convey meaning and resonate with your audience. But creativity isn’t enough. You must also consider the legal aspect.

- Check for similar business names to avoid confusion and legal issues.

- Ensure the name is not trademarked by another company to prevent infringement claims.

- Web domain availability is crucial for an online presence. Check if your business name is available as a web domain.

State Rules And Trademark Checks

Each state in the USA has its own rules for business names. Some states require your business name to reflect the nature of your business. Others may need a specific legal ending, such as ‘LLC’ or ‘Inc.’.

Perform a state-level check through your state’s business filing office to ensure compliance. This prevents legal troubles down the road.

| State | Requirement | Website |

|---|---|---|

| California | Name must be distinguishable | CA Business Portal |

| New York | Must include business type | NY State Business |

Trademark checks are also vital. Use the United States Patent and Trademark Office’s (USPTO) online database. If the name or a similar one is trademarked, you may need to choose another name.

- Visit the USPTO website.

- Search the Trademark Electronic Search System (TESS).

- Review the results for potential conflicts.

Registering Your Business Name

Choosing the right name sets the tone for your business. It is the identity customers will remember. But before you print business cards, make sure the name is legally yours to use. This means you need to register it properly. Let’s dive into the steps to register your business name in the USA.

Doing Business As (dba): When And How

A DBA lets you conduct business under a name other than your own. It’s useful if you’re a sole proprietor or partnership. It helps create a professional image. Here is how to file a DBA:

- Check name availability in your state’s database.

- File the DBA with your state or county clerk’s office.

- Pay the necessary filing fee.

Remember, a DBA doesn’t offer legal protection for the name. It’s just a registration that you’re doing business under that name.

Navigating The Name Registration Process

Registering your business name is a crucial step. To start, search your state’s database for any matches. This prevents legal issues. Then, follow these steps:

- Decide on your business structure (LLC, corporation, etc.).

- Conduct a thorough name search to ensure uniqueness.

- File for name registration with your state’s business filing agency.

- Pay the filing fee, which varies by state and business structure.

After these steps, you’ll receive confirmation. Your business name is now registered and ready to use!

Obtaining Federal And State Tax Ids

Starting a business in the USA is exciting. One important step is getting tax IDs. This makes sure your business follows tax laws. Let’s talk about federal and state tax IDs now.

Securing An Employer Identification Number (ein)

An EIN is like a social security number for your business. It’s a must for taxes, hiring employees, and opening a bank account. Getting an EIN is easy and free. Just apply online on the IRS website.

Follow these steps to get your EIN:

- Go to the IRS website.

- Fill out Form SS-4.

- Submit the form online or by mail.

You’ll get your EIN quickly, often immediately online.

State Tax Identification Numbers: Are They Necessary?

Each state has different rules for state tax IDs. You might need one for state taxes. It’s like an EIN but for your state. Check with your state’s tax website to see if you need one.

To find out if your state requires a tax ID:

- Visit your state’s tax website.

- Look for information on business tax requirements.

- Contact your state’s tax office if unsure.

Remember, not all businesses need a state tax ID. But if you sell goods or have employees, you likely will.

Permits And Licenses: Staying Compliant

Starting a business in the USA requires more than just a great idea. You must ensure your business is legally compliant. This means securing the right permits and licenses. Without them, you risk hefty fines and legal trouble. Let’s explore the steps to stay on the right side of the law.

Identifying Required Permits

Every business needs specific permits to operate. These vary based on location, industry, and business activities. To identify what you need, start by:

- Checking with your city or county clerk’s office

- Consulting the Small Business Administration’s (SBA) website

- Contacting your state’s business licensing office

Common permits include health permits, signage permits, and building permits. Don’t forget specialized licenses for certain trades, like plumbing or electrical work.

The Process Of Obtaining Business Licenses

Once you know what you need, the process begins. Follow these steps to secure your business licenses:

- Compile necessary documents: This may include your business plan, tax identification number, and proof of business name.

- Submit your application: Either online, by mail, or in person.

- Pay required fees: These vary depending on your business type and location.

Remember to renew your licenses as needed. Set reminders for renewal deadlines to avoid penalties.

Taking these steps ensures your business operates smoothly and legally. With the right permits and licenses, you set a solid foundation for your business’s success.

Understanding Zoning Laws And Regulations

Understanding Zoning Laws and Regulations is a key step in registering your business in the USA. Zoning laws determine where a business can operate. They affect factors like parking, signage, and the type of activities a business can conduct. Before choosing a location, it’s crucial to understand these laws to ensure your business complies from day one.

Location Analysis For Your Business

Choosing the right location is more than finding a great spot. It involves analyzing how zoning laws will impact your business. Start with these steps:

- Research local zoning ordinances to find suitable areas for your business type.

- Check if any special permits or licenses are required for your chosen location.

- Consider the future growth of the area and how it aligns with your business plans.

Use online tools or visit local government offices for detailed zoning maps and regulations.

Navigating Zoning Restrictions

Once you find a potential location, delve deeper into the zoning restrictions. Here’s how:

- Contact the city’s planning department for specific zoning laws regarding your business.

- Understand the implications of these laws on your business operations.

- If necessary, explore how to apply for a variance or conditional use permit.

Getting ahead of zoning issues can save time and prevent legal problems down the line.

Credit: medium.com

Opening A Business Bank Account

Opening a Business Bank Account is a crucial step in establishing your business in the USA. It ensures financial clarity and professionalism. A dedicated business account simplifies accounting, tax filing, and provides a clear financial history for your company. Let’s explore how to separate personal and finance accounts and choose the right bank for your business.

Separating Personal And Business Finances

Keeping personal and business finances distinct is essential. It protects personal assets and streamlines bookkeeping. To begin, follow these steps:

- Obtain an Employer Identification Number (EIN) from the IRS.

- Gather necessary documents: business formation papers, ownership agreements, and business license.

- Open a business checking account under your business name using the collected documents.

- Apply for a business credit card to manage business expenses separately.

- Use accounting software to track all business transactions effectively.

Choosing The Right Bank For Your Business Needs

Selecting a bank that aligns with your business goals is important. Consider these factors:

| Factor | Details |

|---|---|

| Services Offered | Check if the bank provides services like online banking, mobile deposits, and merchant services. |

| Fees Structure | Understand the fee for account maintenance, transactions, and additional services. |

| Interest Rates | Compare interest rates for savings accounts and loans across different banks. |

| Customer Support | Ensure the bank offers reliable customer service for any queries or issues. |

| Accessibility | Consider the bank’s location, ATM network, and ease of making deposits and withdrawals. |

Research is key. Visit bank websites, read reviews, and talk to other business owners. Choose a bank that best suits your business needs and growth plans.

Protecting Your Business With Insurance

Registering your business in the USA involves several steps, including protecting it with the right insurance. Insurance shields your business from unexpected events that could be financially damaging. Understanding what kind of insurance you need is crucial for long-term stability and security.

Assessing Your Business Insurance Needs

To start, evaluate the risks associated with your business. Every business has unique risks based on its industry, size, and location. Identifying these risks helps tailor your insurance coverage to fit your needs precisely. Here’s a simple list to help you start:

- Consider the nature of your business operations.

- Analyze the physical assets you own, like equipment and property.

- Think about the potential legal liabilities.

- Assess the health and safety risks to employees and customers.

Once you understand these factors, you can discuss them with an insurance agent who will help you find the best coverage options available.

Types Of Insurance Policies For Small Businesses

Several types of insurance policies cater specifically to the needs of small businesses. Here’s a breakdown:

| Type of Insurance | Purpose |

|---|---|

| General Liability Insurance | Covers legal fees and damages if your business is sued. |

| Property Insurance | Protects your physical assets against fire, theft, and other perils. |

| Workers’ Compensation Insurance | Provides benefits to employees for work-related injuries or illnesses. |

| Professional Liability Insurance | Covers claims of negligence or harm from professional services. |

| Product Liability Insurance | Protects against lawsuits from product-related injuries or damage. |

Choosing the right mix of insurance policies will help protect your business from major financial losses. Speak with a professional to ensure you get coverage that matches your specific needs.

Credit: synder.com

Maintaining Compliance

Maintaining compliance is crucial for any business operating in the USA. To ensure your business stays on the right side of the law, understanding and adhering to the necessary annual obligations is vital. This includes staying current with all reporting requirements and renewing registrations on time. Let’s delve into the specifics to keep your business thriving and compliant.

Annual Reporting And Renewals

To keep your business active, you must complete certain tasks each year. These tasks vary by state and business structure. Below are key points for annual compliance:

- File annual reports: Most states require businesses to submit an annual report. This report updates the state on any changes in your business.

- Renew registrations: If your business is registered as a foreign entity in other states, you must renew these registrations annually.

- Pay necessary fees: Along with reports, states often require a filing fee. Failing to pay can result in penalties.

Keep track of deadlines with a compliance calendar. This can prevent missed filings and extra costs.

Keeping Up With Changing Laws And Regulations

Laws and regulations evolve constantly. Staying informed is not just wise—it’s essential. Here’s how to stay updated:

- Monitor government websites: They provide updates on legal changes that may affect your business.

- Subscribe to newsletters: Industry-specific newsletters can be a reliable source for regulatory changes.

- Consult with professionals: Lawyers and accountants offer expert advice on compliance matters.

Regularly reviewing your business practices ensures alignment with current laws. This proactive approach can save you from future legal troubles.

Conclusion: Launching Your Registered Business

Welcome to the final step in establishing your business in the USA! With diligence and attention to detail, you’ve navigated the registration process. It’s time to open your doors and welcome the world into your new venture. Before you do, let’s run through a final checklist to ensure a smooth launch.

Final Checklist Before Opening Your Doors

- Verify compliance with all local, state, and federal regulations.

- Set up your accounting system to track expenses and income.

- Review your business plan and adjust for any new insights.

- Confirm your business insurance policies are in place.

- Test your operational workflow to iron out any issues.

- Prepare your marketing materials and online presence.

- Organize a grand opening event to generate buzz.

- Train your staff to provide exceptional customer service.

The Journey Ahead: Growing Your Registered Business

With your doors open, the real journey begins. Growth requires strategy, adaptability, and perseverance. Keep these tips in mind:

- Monitor your market for changes and opportunities.

- Seek feedback and use it to improve your offerings.

- Invest in marketing to reach new customers and retain existing ones.

- Explore new revenue streams to diversify your income.

- Stay on top of financial management to maintain a healthy cash flow.

- Network with other businesses for partnerships and growth ideas.

- Continuously innovate to stay ahead in your industry.

Credit: sellvia.com

Frequently Asked Questions

How Much Does It Cost To Register A Business In Usa?

The cost to register a business in the USA varies by state, ranging from $40 to $500. Specific fees depend on the state and the business structure, such as LLC, corporation, or sole proprietorship. Always check local regulations for precise costs.

How Can I Register A Business In The Us?

To register a business in the US, choose a business structure and a unique name. Next, file the necessary documents with your state’s business registration office. Finally, obtain any required permits or licenses, and apply for an Employer Identification Number (EIN) with the IRS.

Can I Open A Business In The Usa As A Foreigner?

Yes, foreigners can open a business in the USA. There are no citizenship or residency requirements for starting a company.

How Do I Register My Llc In The Us?

Choose your state of formation and LLC name. File Articles of Organization with the state. Appoint a registered agent. Draft an LLC Operating Agreement. Obtain necessary business licenses and EIN.

Conclusion

Embarking on the journey of business registration in the USA can be daunting, yet it’s a vital step toward legitimacy and growth. With the right guidance, the process can be straightforward and rewarding. Remember, every successful enterprise begins with a solid foundation.

So, take that first step, register your business, and set the stage for your American dream to flourish.

Sotto TV Sotto TV বাংলাদেশের একটি জনপ্রিয় ওয়েব পোর্টাল। যেখানে টেকনোলজি,বিভিন্ন ধরনের টিপস,ক্যারিয়ার টিপস,ব্যাংকিং ইনফর্মেশন, অনলাইনে আয় করার পদ্ধতি এবং সাম্প্রতিক সময়ে ঘটে যাওয়া সকল আপডেট তথ্য প্রকাশ করা হয়।

Sotto TV Sotto TV বাংলাদেশের একটি জনপ্রিয় ওয়েব পোর্টাল। যেখানে টেকনোলজি,বিভিন্ন ধরনের টিপস,ক্যারিয়ার টিপস,ব্যাংকিং ইনফর্মেশন, অনলাইনে আয় করার পদ্ধতি এবং সাম্প্রতিক সময়ে ঘটে যাওয়া সকল আপডেট তথ্য প্রকাশ করা হয়।