US business tax is a levy imposed on the earnings of companies operating in the United States. The corporate tax rate stands at a flat 21% following the Tax Cuts and Jobs Act of 2017.

Navigating the complexities of US business tax requires a solid understanding of the regulations and obligations that come with corporate operations. The tax system encompasses various deductions, credits, and allowances that can significantly affect a company’s financial responsibilities. Businesses must comply with federal, state, and local tax laws, which involve filing annual returns and making quarterly payments.

Staying informed about tax law changes is crucial for companies to optimize their tax positions and avoid penalties. Effective tax planning strategies are essential for businesses seeking to minimize their tax liabilities while adhering to all legal requirements. By understanding the nuances of the US tax code, companies can better plan their investments and operations to ensure financial efficiency and regulatory compliance.

Credit: taxfoundation.org

Navigating Us Business Taxes

Understanding taxes is crucial for any business in the US. Taxes can be complex and varied. Businesses must comply with federal, state, and local tax laws. This section breaks down the essentials of US business taxes. It guides you through key components and common obligations.

Key Components Of The Tax System

The US tax system has several layers. Businesses need to grasp these to manage their finances effectively.

- Income Tax: This tax is on the money your business earns.

- Self-Employment Tax: For sole proprietors and partners, this covers Social Security and Medicare.

- Payroll Tax: If you have employees, you must handle taxes withheld from their paychecks.

- Sales Tax: Collected from customers, this varies by state and locality.

- Excise Tax: This applies to specific products or services.

Each tax has its rules, rates, and deadlines. Businesses must track these details closely.

Common Tax Obligations For Businesses

Meeting tax obligations is non-negotiable. Below are some you might encounter:

| Type of Tax | Description | Reporting Frequency |

|---|---|---|

| Income Tax | Based on earnings | Annual |

| Estimated Tax | For businesses expecting to owe tax | Quarterly |

| Employment Tax | For those with employees | Quarterly or Annually |

| Sales Tax | Collected from customers | Monthly or Quarterly |

| Excise Tax | On specific goods | Varies |

Keep records up-to-date and file returns on time. Penalties for late or incorrect filings can be steep.

Choosing The Right Business Structure

Choosing the right business structure is crucial. It affects your taxes, paperwork, and personal liability. Your decision impacts how much you pay in taxes, your ability to raise money, and the rules you need to follow.

Tax Implications Of Different Entities

The type of entity you choose influences your tax obligations. Here are key structures:

- Sole Proprietorship: You pay taxes on business income through your personal tax return.

- Partnership: Like sole proprietors, partners file taxes on personal returns. The business itself doesn’t pay tax.

- Corporation (C Corp): It’s taxed as a separate entity. This can lead to double taxation—first on profits, then on dividends to shareholders.

- S Corporation: Profits and losses pass through to your personal tax return. This avoids double taxation.

- Limited Liability Company (LLC): Members choose how to be taxed, like a sole proprietor, partnership, or corporation.

How Structure Affects Your Tax Burden

Choosing a business structure affects your yearly tax burden. See the differences:

| Structure | Tax Responsibility | Filing Complexity |

|---|---|---|

| Sole Proprietorship | Lowest tax burden; personal tax rates. | Simplest; Schedule C with personal taxes. |

| Partnership | Pass-through; file Form 1065. | Moderate; requires partnership return. |

| Corporation (C Corp) | Highest; corporate tax rate plus dividends tax. | Complex; corporate return and possible double taxation. |

| S Corporation | Pass-through; personal tax rates. | More complex; Form 1120S required. |

| LLC | Flexible; depends on chosen tax treatment. | Varies; can be simple or complex. |

Each structure offers different benefits and challenges. Your choice determines your tax filing requirements and potential deductions.

Deductibles And Credits

Understanding the world of U.S. business taxes can unlock savings for your company. Focus on deductibles and credits. This section will guide you through maximizing your tax deductions and understanding how tax credits can reduce your tax bill. Let’s dive into the strategies that can keep more money in your business pocket.

Maximizing Deductions

Maximizing deductions lowers taxable income. It’s crucial for businesses to know what they can write off. Here’s how to ensure you’re not leaving money on the table:

- Keep thorough records of all expenses. Good records support your deductions.

- Understand your industry-specific deductions. Some industries have unique write-offs.

- Regularly review your expenses for potential deductions.

- Consult with a tax professional to identify less obvious deductions.

Some common deductions include:

| Expense Type | Examples |

|---|---|

| Office Supplies | Paper, printers, computers |

| Travel | Flights, hotels, mileage |

| Professional Services | Legal advice, accounting |

| Education | Workshops, seminars, webinars |

Understanding Tax Credits

Tax credits are direct cuts from your tax bill. They are better than deductions as they reduce tax dollar-for-dollar. Here are key points to understand about tax credits:

- Know the difference between refundable and non-refundable credits.

- Identify credits applicable to your business, like the R&D tax credit for innovation.

- Keep up-to-date with new credits available each tax year.

- Use available software or a professional to calculate credits accurately.

Examples of tax credits include:

- Small Business Health Care Tax Credit for providing employee health insurance.

- Work Opportunity Tax Credit for hiring from certain groups.

- Energy Credits for using renewable energy.

Accounting Strategies For Tax Efficiency

Smart accounting strategies can save US businesses a lot of money come tax time. Knowing the right approaches can mean paying only what you owe, and not a cent more. Let’s dive into some strategies that can help your business stay tax efficient.

Accrual Vs. Cash Basis Accounting

Two main accounting methods can impact your taxes: accrual and cash basis. The accrual method records income and expenses when they’re billed and earned, regardless of when the money changes hands. In contrast, the cash basis method records transactions only when cash is received or paid. Your choice can affect your tax bill and cash flow.

- Accrual Accounting:

- Offers a more accurate picture of financial health.

- Is required for businesses over a certain size.

- Cash Basis Accounting:

- Is simpler and may help manage taxes in the short term.

- Can defer income and accelerate deductions.

Keeping Accurate Records

Accurate record-keeping is essential for tax efficiency. It helps you track expenses, income, and potential deductions. A strong record-keeping system can make sure you don’t miss out on valuable tax breaks. Consider using digital tools to maintain your records efficiently.

| Record Type | Importance | Tool Example |

|---|---|---|

| Receipts | Prove expenses | Receipt scanning apps |

| Bank Statements | Show income and expenses | Online banking |

| Tax Documents | Needed for filing | Cloud storage |

Remember to keep records for at least three years, as required by the IRS. For certain documents, longer retention may be necessary.

Investing In Qualified Retirement Plans

Saving for the future is a smart move for any business owner. Qualified retirement plans offer a way to save money while reducing taxes. This section explains the benefits of retirement savings and the types of plans available.

Benefits Of Retirement Savings

Retirement savings serve two main purposes: securing your financial future and providing tax benefits. By investing in a retirement plan, you can grow your nest egg. This money grows tax-free until you take it out. Also, contributions to these plans can lower your taxable income. This means you pay less in taxes now.

- Save money for later in life

- Pay less in taxes today

- Money grows tax-free

Types Of Plans And Tax Advantages

Many types of retirement plans exist, each with unique tax advantages. Here is a quick overview:

| Type of Plan | Who It’s For | Tax Benefit |

|---|---|---|

| 401(k) | Employees of a company | Pre-tax contributions |

| Solo 401(k) | Business owners with no employees | Higher contribution limits |

| SEP IRA | Self-employed or small business owners | Simple to set up and maintain |

| Simple IRA | Small businesses | Lower costs and simple plan rules |

Each plan has rules about who can join and how much you can put in. Your business type will guide your plan choice. The tax benefits can vary, but they all aim to lower your tax bill now or in the future.

Tax-smart Investment Decisions

Making tax-smart investment decisions is crucial for US businesses. It can lead to significant tax savings. Investments must align with business goals and tax strategies. This ensures growth while minimizing tax liabilities.

Understanding Capital Gains Tax

Capital gains tax affects profits from asset sales. Short-term gains get taxed as ordinary income. Long-term gains have lower tax rates. Timing asset sales can reduce tax bills.

- Short-term: Assets held for less than a year.

- Long-term: Assets held for more than a year.

Businesses should plan sales around tax brackets. They must consider holding periods. This strategy can boost after-tax returns.

Choosing Tax-efficient Investments

Selecting tax-efficient investments can lower annual tax costs. Tax-advantaged accounts and assets offer benefits. Examples include retirement accounts and municipal bonds.

| Investment Type | Benefits |

|---|---|

| Retirement Accounts | Deferred taxes, potential deductions |

| Municipal Bonds | Tax-free interest at federal level |

Businesses should balance portfolios. They need a mix of growth and income assets. This diversification helps manage risk and tax exposure.

Strategic Timing Of Income And Expenses

Understanding the strategic timing of income and expenses is crucial for businesses. It can lead to significant tax savings. The goal is to manage when money comes in and goes out. This can lower taxes in the current year. Smart planning involves two main strategies: deferring income and accelerating expenses.

Deferring Income To Reduce Current Taxes

Pushing income into the next year can lower your tax bill now. This is because you pay taxes on income when received. Here are ways to defer income:

- Delay Invoices: Wait until the end of December to send out invoices. This means you’ll receive payment in the new year.

- Use Retirement Plans: Contribute to a retirement plan. Money put in these plans isn’t taxed until withdrawn.

Accelerating Expenses To Increase Deductions

Paying for business expenses before the year ends can increase deductions. This can reduce taxable income. Consider these tips:

- Prepay Bills: Pay next month’s bills now. This includes rent, utilities, or subscriptions.

- Stock Up: Buy office supplies or inventory you’ll need soon. Do this before the year’s end to claim the expense.

Plan carefully. Each business is different. A tax professional can help decide the best moves for your situation.

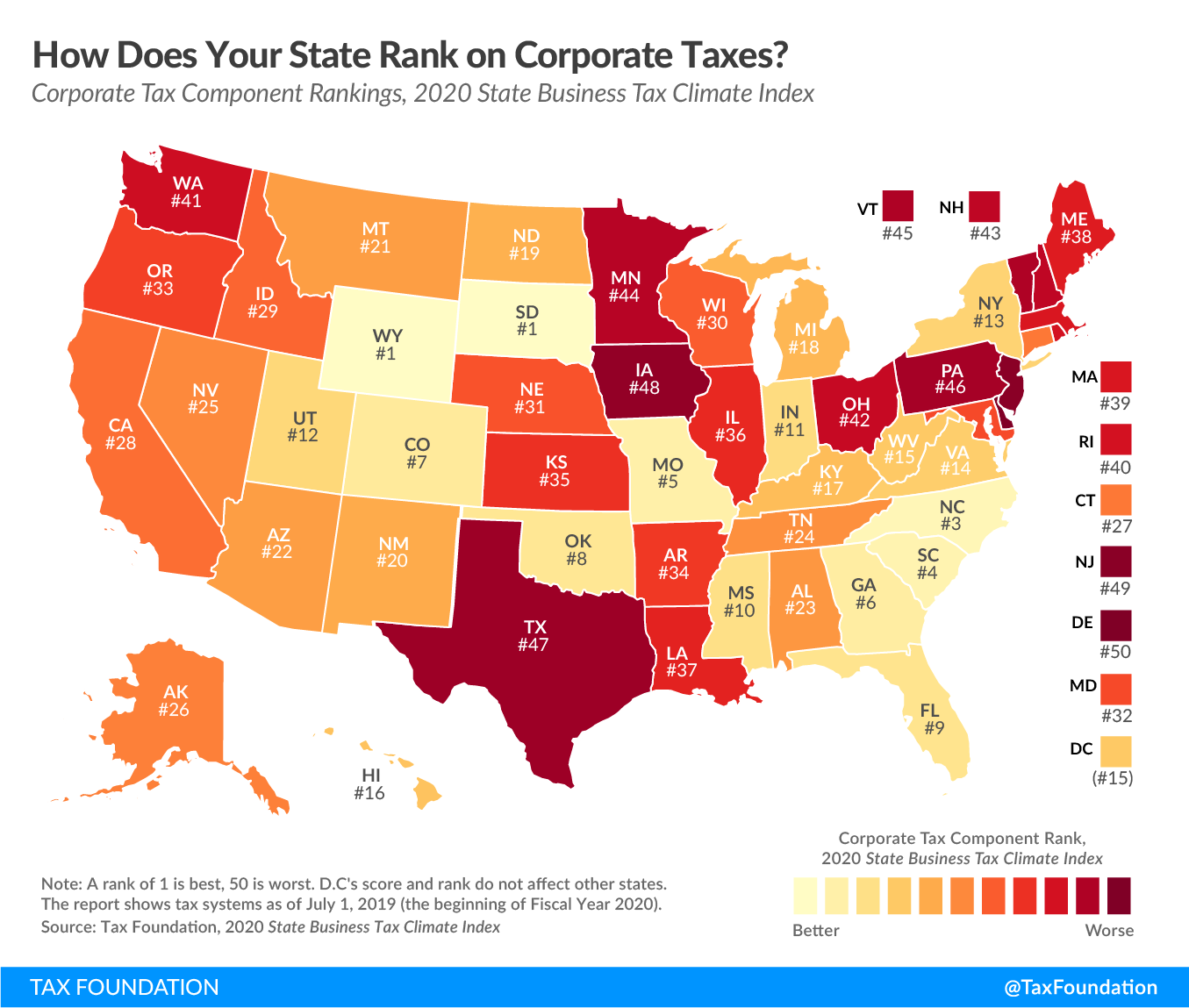

Credit: taxfoundation.org

Navigating State And Local Taxes

Understanding state and local taxes is vital for US businesses. Each state has unique tax laws. These taxes affect your business operations. Knowing these can save money and avoid penalties.

State Tax Variations And Considerations

State tax laws differ widely. Business owners must know their state’s specific requirements. This includes income tax, franchise tax, and property tax.

- Income Tax: Some states have high rates, others have none.

- Franchise Tax: This applies to the privilege of operating in a state.

- Property Tax: Rates can vary and affect your business location choice.

Research is key. Check state departments for up-to-date tax information. Use professional help if needed. It keeps your business compliant.

Dealing With Sales And Use Taxes

Sales tax applies to goods and certain services. Use tax is for out-of-state purchases. Know the rules to charge customers correctly.

| Task | Action Required |

|---|---|

| Register for Sales Tax | Do this in states where you have a nexus. |

| Calculate Sales Tax | Use the correct rate for each location. |

| File Tax Returns | Submit them by the due dates. |

Stay organized. Keep records of all sales and taxes collected. Use software for accuracy. This makes tax filing easier.

Avoiding Common Tax Pitfalls

Navigating U.S. business tax can be tricky. Missteps can lead to severe penalties. This section highlights key areas to watch out for, helping you avoid common tax pitfalls.

Penalties For Underpayment And Late Filing

Underpaying or late filing your taxes can bring hefty fines. Here are the main penalties:

- Failure to file: This penalty is usually 5% of unpaid taxes for each month.

- Failure to pay: You’ll face a charge of 0.5% per month on the taxes owed.

- Combined penalty: If both apply, the maximum charge per month is 5%.

To avoid these, always ensure timely and accurate tax submissions.

Risks Of Aggressive Tax Strategies

Aggressive tax strategies may promise big savings but come with risks:

| Strategy | Risk |

|---|---|

| Overstating deductions | Audit and penalties |

| Hiding income | Criminal charges |

| Using unproven tax shelters | Penalties and interest |

Sticking to proven, conservative strategies is the safest route.

Leveraging Professional Tax Assistance

Understanding US business tax can be tricky. A smart move for any business owner is to consider professional tax help. This assistance can save time and money. Let’s explore the advantages of hiring a tax professional and ongoing tax planning support.

When To Hire A Tax Professional

Complex tax rules make it hard for business owners to keep up. It’s time to hire a tax pro:

- Business growth: More sales mean more tax details.

- New tax laws: Tax pros stay updated on changes.

- Audit worries: Pros can ease these concerns.

- Time savings: They handle taxes while you run the business.

Benefits Of Ongoing Tax Planning Support

Ongoing support from a tax expert brings big benefits:

| Benefit | Description |

|---|---|

| Lower tax bills | Experts find deductions and credits. |

| Financial health | Regular check-ups keep finances in shape. |

| Less stress | Professionals handle tax deadlines. |

| Strategic planning | They help plan big financial moves. |

Credit: en.wikipedia.org

Frequently Asked Questions

What Taxes Do Us Businesses Pay?

US businesses pay several taxes, including federal and state income taxes, payroll taxes, sales taxes, property taxes, and excise taxes. Specific tax obligations vary by business structure and location.

How Is A Us Llc Taxed?

A US LLC is taxed as a pass-through entity by default, meaning profits and losses pass through to owners’ personal tax returns. Owners pay personal income tax on these earnings. Alternatively, an LLC can choose to be taxed as a corporation.

What Is The Tax Rate On Llc In Usa?

The tax rate for an LLC in the USA varies based on the entity’s chosen tax classification. LLCs can opt for taxation as a disregarded entity, partnership, or corporation, with rates ranging from 10% to 37% for individuals and 21% for corporations.

How Much Does The Irs Tax A Small Business?

The IRS taxes small businesses based on their structure, with rates varying from 10% to 37%. Sole proprietorships, partnerships, and S corporations report taxes on personal returns, while C corporations face a flat 21% rate. Specific tax obligations depend on income and business type.

Conclusion

Navigating US business tax obligations requires diligence and expertise. With the right strategies, companies can optimize their tax positions. Remember, seeking professional advice is key. Stay informed, compliant, and proactive to make tax season less daunting. Your business’s financial health depends on it.

Sotto TV Sotto TV বাংলাদেশের একটি জনপ্রিয় ওয়েব পোর্টাল। যেখানে টেকনোলজি,বিভিন্ন ধরনের টিপস,ক্যারিয়ার টিপস,ব্যাংকিং ইনফর্মেশন, অনলাইনে আয় করার পদ্ধতি এবং সাম্প্রতিক সময়ে ঘটে যাওয়া সকল আপডেট তথ্য প্রকাশ করা হয়।

Sotto TV Sotto TV বাংলাদেশের একটি জনপ্রিয় ওয়েব পোর্টাল। যেখানে টেকনোলজি,বিভিন্ন ধরনের টিপস,ক্যারিয়ার টিপস,ব্যাংকিং ইনফর্মেশন, অনলাইনে আয় করার পদ্ধতি এবং সাম্প্রতিক সময়ে ঘটে যাওয়া সকল আপডেট তথ্য প্রকাশ করা হয়।